We will review and compare the top financial management software to assist you in selecting the best financial management software for your needs.

Financial management, as the name implies, is the management of money. The term is commonly applied to businesses that require proper and accurate financial management in order to succeed and grow in their respective fields.

What is Financial Management Software

Financial management entails organizing, planning, budgeting, financial reporting, forecasting, and prudently allocating an enterprise’s finances in order to maximize profits.

Individuals manage their finances in the same way that businesses do, by creating budgets for future expenses and savings, organizing their spending, and making planned investments.

Financial Management Software is available to make financial management easier, more transparent, accurate, cost-effective, and profitable. See 6 Best Print Management Software For Windows.

Best Financial Management Software

This article will provide you with information on the top financial management software’ top features, cons, prices, and verdicts. Compare them and decide for yourself which one is best for you.

#1. Mvelopes

Mvelopes is a financial management software that helps you plan your budget by providing features that help you pay off debt, increase your savings, and spend wisely.

Features:

- Create a budget in minutes.

- assists you in repaying your debts.

- assists you in increasing your savings.

- Divide your money into different envelopes, each with a specific purpose.

#2. Personal Capital

Personal Capital is a financial management software that helps you manage your cash flow, wealth, and budgets so that you can plan for your retirement using the software’s personal strategies.

Features:

- Seek expert advice to develop future-planning strategies.

- assists in reducing tax expenditure.

- It is possible to use it both online and through the mobile application.

- Plan your savings and spending according to your net worth and liabilities.

#3. Mint

Free Mint is a free financial management software and the most downloaded personal finance app, assisting you in refining your spending habits, reminding you to pay your bills on time, and providing you with personalized insights about your credit flow so that you can spend and save wisely.

Features:

- Budgeting tailored to your income and expenses

- Keep track of your spending so that you can cut it back if necessary.

- monitors your credit flow, generates reports, and makes recommendations.

- Your data is kept safe with 256-bit encryption.

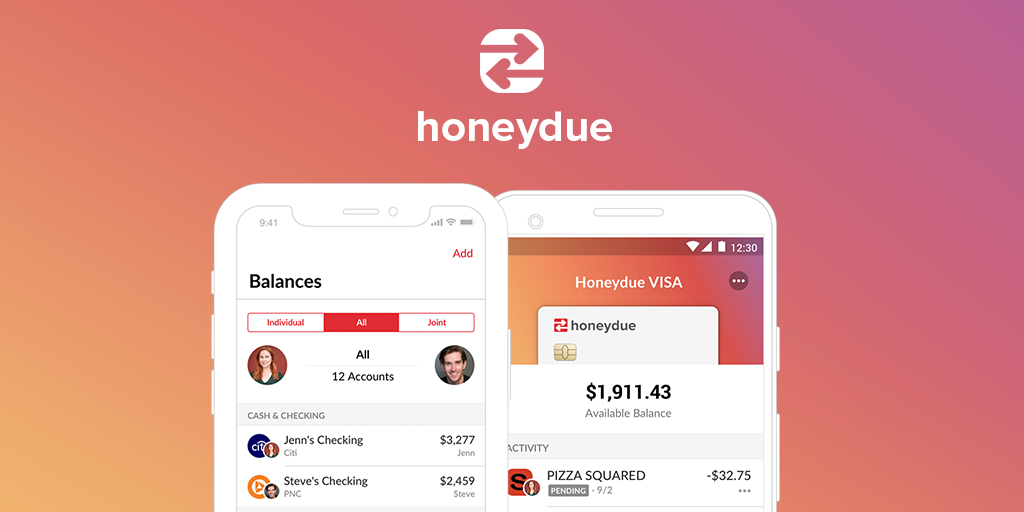

#4. Honeydue

Features:

- Spend and save money together with your partner.

- Multilingual: English (US, UK, and Canada), Spanish, and French are supported.

- It safeguards you against fraud. The FDIC insures your deposits.

- Each partner’s budget and instant notifications

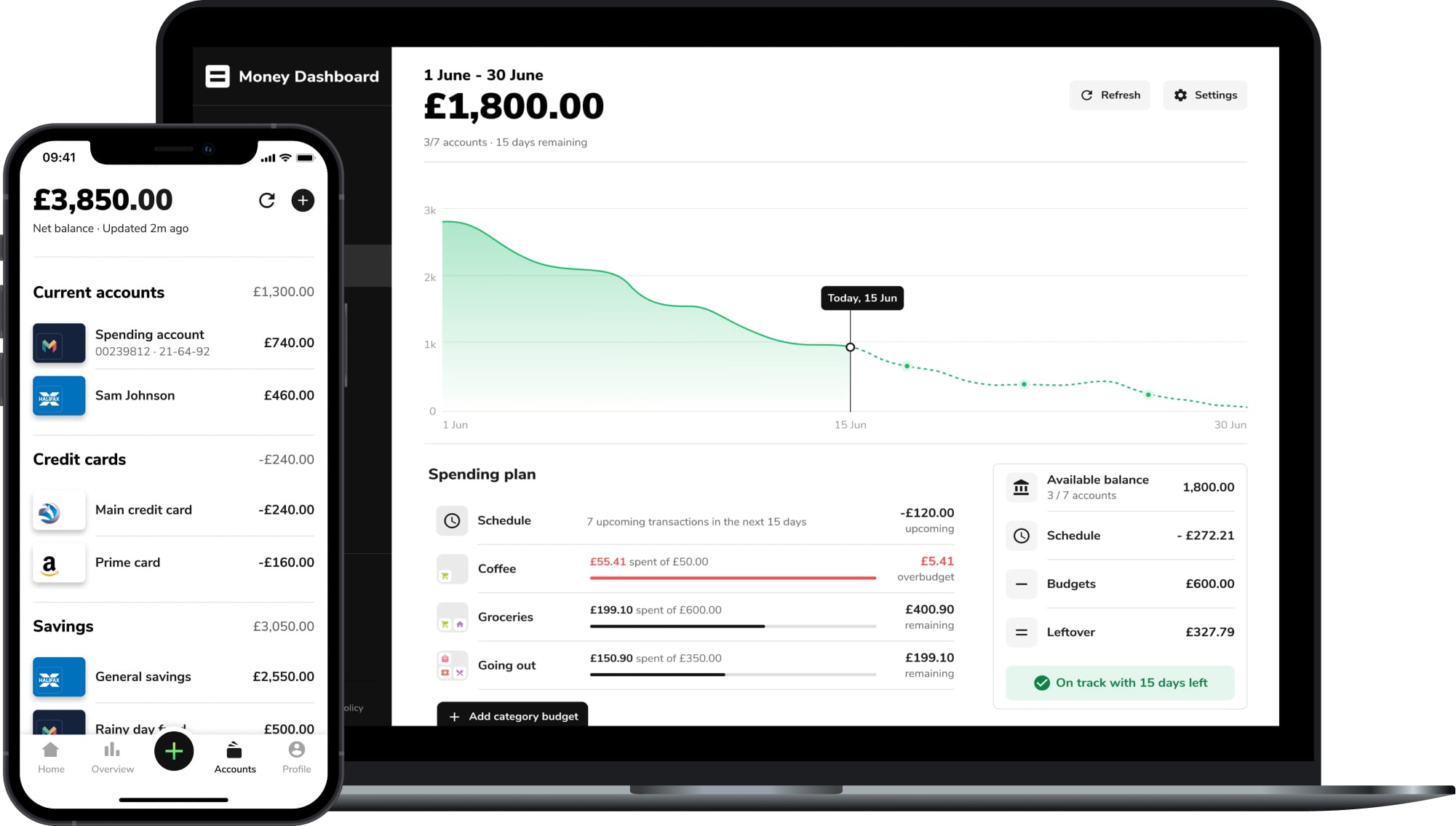

#5. Money Dashboard

Money Dashboard is a web-based financial management software that manages all of your accounts and assists you in increasing your savings by informing you of how much net money you have after paying your bills on a regular basis.

Features:

- Plan your spending; the software will notify you from time to time of the funds available for saving after you have paid your bills.

- All of your bills and subscriptions can be found in one place.

- Keep track of your spending so you can cut back on unnecessary purchases to save for unforeseen circumstances.

- can instantly connect with banks or financial providers to help you retrieve or transfer money.

#6. FutureAdvisor

Future Advisor is one of the best financial management software available, assisting you in making wise investments by providing expert advice and assisting you in creating digital portfolios. You can log in to your account at any time.

Features:

- manages your wealth by reducing taxes, recommending diverse investment opportunities and overseeing multiple accounts.

- Tax-Loss Harvesting: If any of your investments lose value, the system will defer taxes to save you money.

- When you need cash, the system sells some of your assets to provide you with cash while ensuring that your remaining assets are well diversified.

- makes decisions to maintain the value of your portfolio while considering your risk tolerance and how to save for retirement.

#7. PocketGuard

PocketGuard’s goal is to simplify your finances by taking control of your savings through the autosave feature. It displays your spending across various departments, allowing you to cut unnecessary spending and save more money.

Features:

- Set your goals, and the system will show you how much money is left over after you’ve paid your bills and necessary expenses.

- Plan your spending and cut unnecessary expenses to meet your savings goals.

- Examine your accounts and cash flow in one place.

- PocketGuard even assists you in negotiating lower interest rates on your bills.

- 256-bit SSL encryption protects your data.

- The autosave option allows you to save the amount you want to save each month automatically. You can withdraw cash from your auto-saved funds at any time.

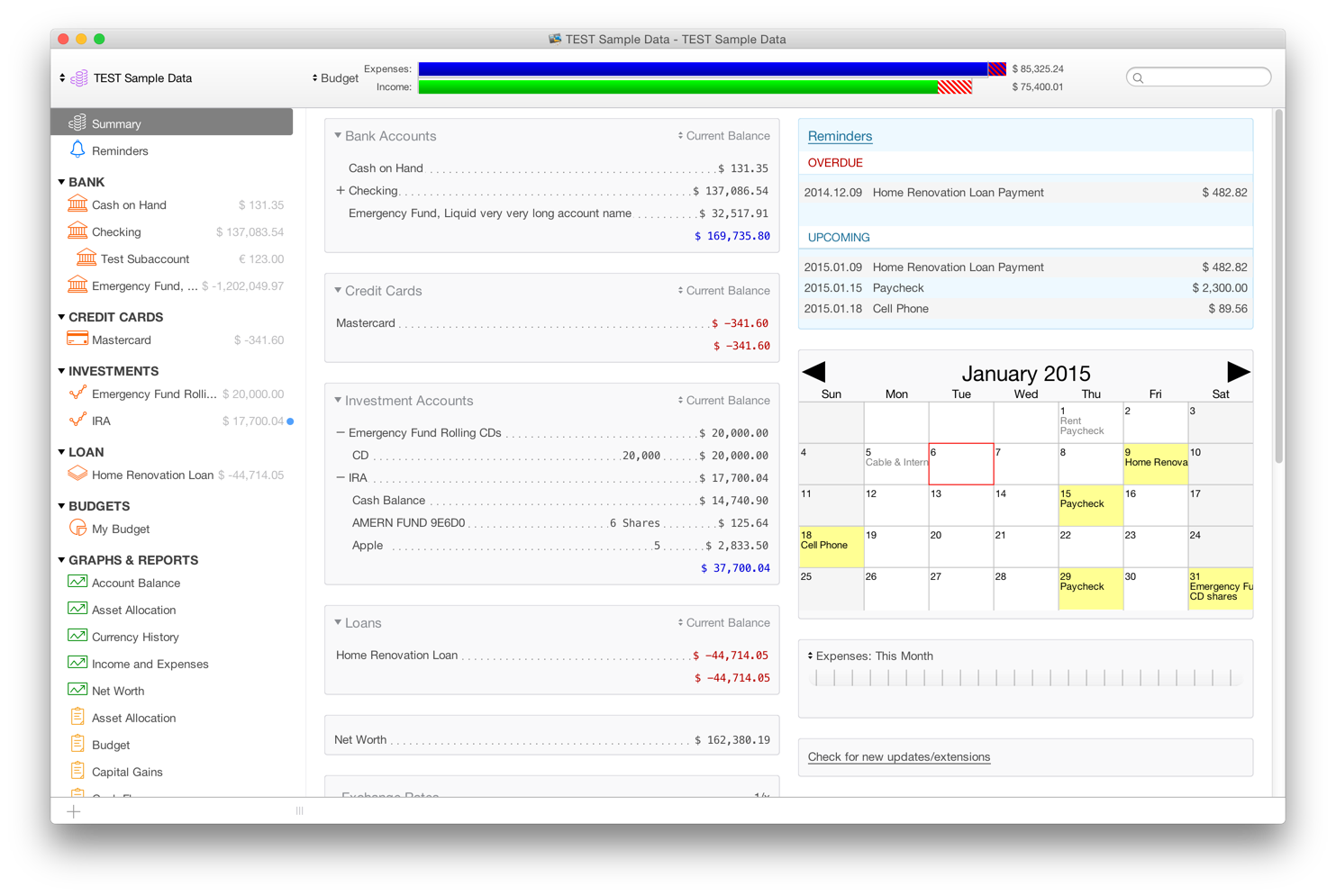

#8. Moneydance

Moneydance is a personal finance app that helps you manage your finances, and budget, and makes investing easier and more productive.

Features:

- It connects to hundreds of financial institutions and automatically sends payments.

- provides you with financial reports that include a summary of your cash flow.

- Graphs are used to provide reporting.

- Set up bill payment reminders and never pay a late fee.

- It assists investors by displaying the current prices or performance of various stocks, bonds, mutual funds, and other financial instruments.

#9. GoodBudget

GoodBudget is a financial management software that assists you in maintaining a budget using the envelope budgeting method so that you can save for the things that are most important in your life.

Features:

- Envelope budgeting allows you to allocate your net worth to various categories (envelopes) to ensure purposeful spending.

- Sync or share your budget with others so that you can spend and save together.

- It enables you to pay off debt while also saving.

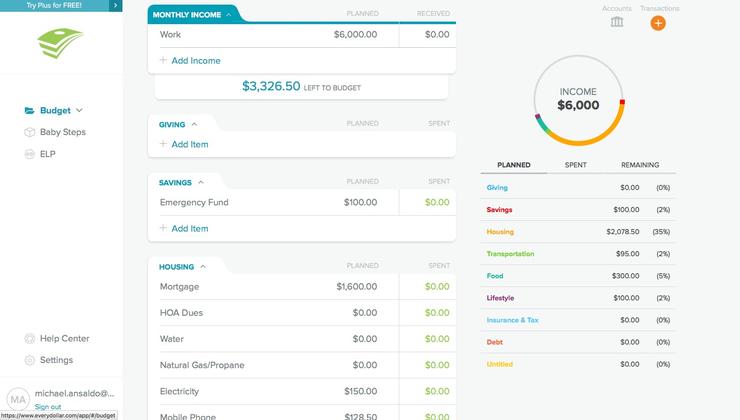

#10. EveryDollar

EveryDollar is a budgeting app that assists you in creating a budget so that you can track your spending and devise strategies for saving more money by understanding your cash flow.

Features:

- There are templates that can be customized to help you plan your monthly budget.

- Synchronization allows you to access the application from any device and from any location.

- It creates and reports on every dollar you spend.

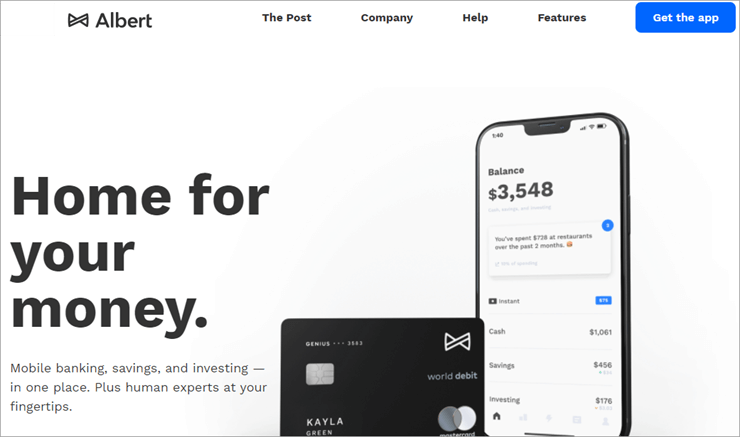

#11. Albert

Albert is one of the best financial management software available, with a wide range of features to help you manage your wealth, achieve your savings goals, get instant cash advances, and get expert advice for investors.

Features:

- If you run out of cash, Albert provides you with an instant cash advance so you can pay your bills on time and repay the amount to the financial management software on your next payday.

- Set your savings goals for multiple purposes and leave the rest to Albert. The system analyses your income, necessities, and other spending habits and automatically saves the rest.

- When you switch to Albert Genius, you will receive a 0.10 percent annual reward on your savings and a 0.25 percent reward.

- Expert advisors to help you invest in

- You can purchase insurance policies for your family and belongings directly from the app.

#12. Yotta

Yotta is a free financial management software that rewards you for saving money. As a reward, you receive 0.20 percent of your savings and have the chance to win up to $10 million in weekly drawings.

Features:

- encourages you to save more by rewarding you with 0.20 percent of your savings.

- Every week, you have a chance to win $10 million.

- Make a deposit to be eligible for lucky draw tickets.

- You can withdraw your deposits at any time, but you only have six withdrawals per month.

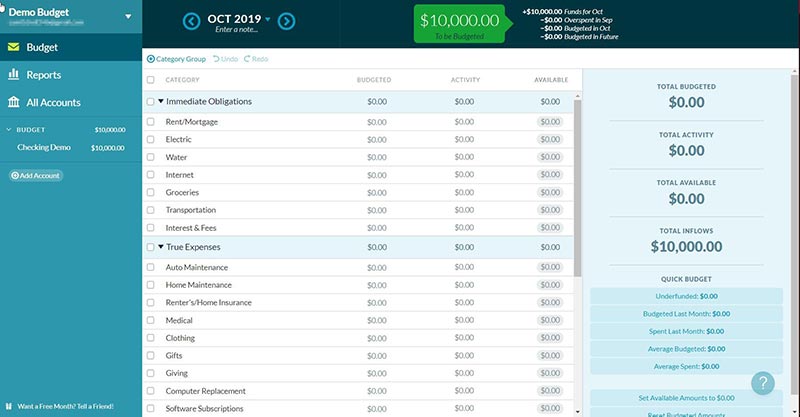

#13. YNAB

YNAB is essentially a budgeting app that aims to help you spend wisely rather than spend less. The software comes with a 34-day free trial and is extremely simple to use.

Features:

- A simple budgeting technique to help you spend more wisely.

- YNAB allows you to sync your data across devices and share your budget with anyone you want to spend and save money with.

- Tracking your income and cash flow assists you in meeting previously set goals.

- It provides free live online workshops for customer support and provides financial reports in the form of graphs and charts.

#14. Quicken

Quicken is a financial management software that simplifies budgeting, provides insight into all of your accounts, expenditures, bill payments, savings, investments, and more, and allows you to pay your bills online via the Quicken application.

Features:

- A single location to view your net worth, spending, savings, and investments, as well as sync your data across devices to access it from anywhere, at any time.

- Create your own budget.

- All of your bills can be paid online or via email.

- Live customer service is available.

- Organize your expenses according to whether they are for personal or professional use.

- Track your spending to reduce unnecessary outgoing funds.

#15. Kissflow Finance & Ops Cloud

Kissflow, while not strictly a financial management tool, is intended to assist you in developing a system of approval workflows for financial processes. There are pre-built apps for purchase orders, invoices, and expense reimbursements, or you can create your own with no coding. Finance process automation can be made a breeze with standardised approval flows and reasonably automated processes.

Kissflow is distinguished by its visual interface, which allows you to tailor the apps to your specific requirements. Regardless of the complexity, no coding is required. If your financial processes include a lot of approvals and repetitive tasks, Kissflow is worth a look.

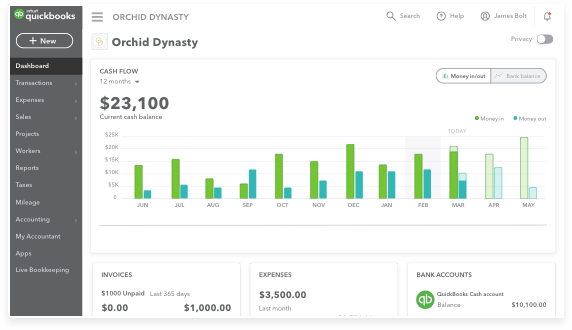

#16. QuickBooks

QuickBooks is a common and comprehensive financial management tool aimed at small and medium-sized businesses as well as accountants. It assists you with bank reconciliation, invoices, expense tracking, payroll, and advanced reporting. There are cloud and on-premise solutions available.

While it is more complicated, its powerful features provide a compelling reason if you frequently deal with high volumes. QB may be too much for a small business with few requirements.

#17. Xero

Xero is accounting software that allows you to generate professional recurring invoices as well as reconcile bank and credit card statements. It also aids businesses in the management of purchase and sales orders, contact management, payroll, and inventory.

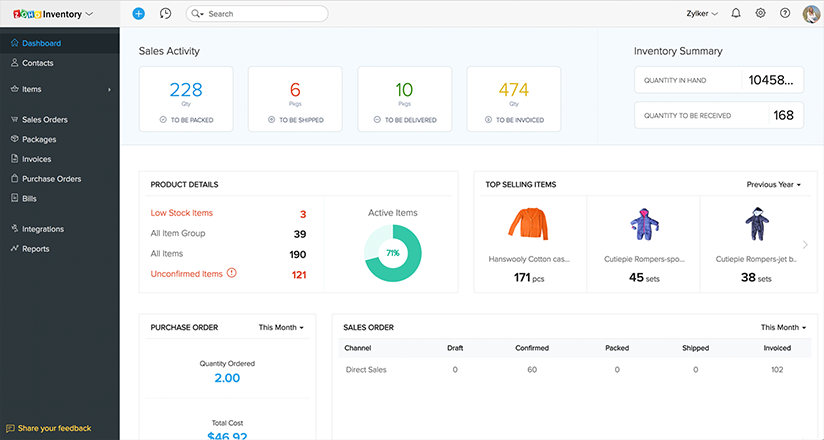

#18. Zoho Finance Plus

Zoho’s finance suite eliminates departmental silos and provides a unified platform for all of your back-office operations, including accounting, invoicing, inventory, expense management, and tax compliance. The suite provides applications that are flexible, scalable, and secure for managing your entire financial process.

Every app is accessible from the other apps, making usage simple. Granular user roles limit access based on your requirements and can be customised to the smallest detail.

#19. Sage Intacct

Sage Intacct applications are appropriate for small and midsize businesses, assisting them in managing the general ledger, accounts payable, accounts receivable, cash management, and order management. You can integrate them with other business applications such as CRM, payroll, or POS systems thanks to their open API structure.

#20. Oracle Financials Cloud

Oracle Financials Cloud is an ERP system that is entirely cloud-based. It is a scalable, comprehensive, and integrated financial tool ecosystem. While it is expensive, it may be a good choice for enterprises seeking greater control and scalability.

Financial Management System Frequently Asked Questions

1. What exactly is financial management?

Answer: It entails prudently organising, planning, allocating, budgeting, and reporting the finances of a business or an individual in order to achieve a set of objectives.

2) What exactly are “financial management skills”?

Financial management abilities include:

- Leadership abilities

- Skills in logic and reasoning

- Thinking critically

- capability to analyze and interpret a set of data.

- Knowledge of commerce, economics, statistics, and mathematics

Q #3: What is the best financial management software?

Answer: Personal Capital, FutureAdvisor, or Quicken are some of the best financial management software, loaded with features to help you with almost all of your financial needs, whereas Mint and Honeydue are free and simple budgeting tools.

Conclusion

For this article, we conducted a thorough investigation into the best available financial management systems on the market.

Based on our research, we can now conclude that if you need a simple budgeting application, you should use YNAB, Mint, Honeydue, Mvelopes, GoodBudget, or EveryDollar. Mint and Honeydue are completely free to use, which gives them a significant advantage over the others.